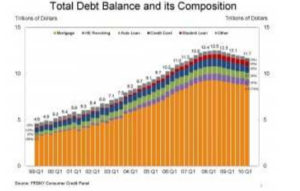

Why are we in debt? And, why do we believe we are in debt? It is not a question of whether we are in debt: we are. In recent years, from Turkey to the United Kingdom, credit card debt reached North American levels, as a percentage of disposable income. As a journalist noted just before the financial crisis, “few American exports have proved as popular as credit cards.” Below is the Federal Reserve’s picture of the total consumer debt of Americans: according to one estimate based on their figures, every man, woman and child in the United States owes $7,800, a third in revolving credit card debt and two-thirds in installment debt, mainly student loans and auto loans. And that figure doesn’t count mortgage loans. About twelve percent of after-tax income goes to paying mortgage and consumer debt. [1]Mark Landler, “Outside U.S., Credit Cards Tighten Grip,” New York Times (August 9, 2008)

The first two questions are, however, a little more complicated. Why are we in debt? And why do we believe that we are in debt?

Despite the rhetoric of financial journalists, our debts are not the same as those of Google, General Motors or WalMart. Ordinary debt-crisis talk conflates two completely different processes: on the one hand, the credit system; on the other hand, living in debt, part of the daily life of wage earners. Most of the analyses of debt and the financial crisis focus on the first process. The credit or financial system is, as David Harvey has shown, “the distinctive child of the capitalist mode of production” and it “depicts relations within the capitalist class.”[2]David Harvey, The Limits to Capital (Chicago: University of Chicago Press, 1982), pp. 253, 239 (my emphasis).

Here credit is the creation of “fictitious capital” to accelerate the process of the accumulation; and interest is that part of surplus value which is distributed to those capitalists who keep capital’s blood circulating. For most of political economy, discussions of debt focus on this system of capitalist credit.

But our debt, living in debt, is not a capital investment; it is not even like the debt of sharecroppers or debt peons who borrow to acquire the seeds and tools needed to produce their cash crops. Rather, our debt was contracted to cover the costs of “consumption,” to secure the very means of subsistence, and to smooth the micro-booms and micro-busts between paychecks.

Consumer debt, or household debt, is thus the debt that we take out to pay for the production of our own household’s labor power, that commodity we offer for sale on the “job market.” In order for wage earners to sell their time, they must already have sustained their life, and the revolving debts of ordinary working-class life are those that maintain (to use Marx’s somewhat archaic language) the means of subsistence, the means of procreation, and the means of training and education. In the unfinished draft of Capital’s third volume, Marx noted that debt was a “standard accompaniment to [workers’]…use of many consumption fund items”, and he argued that the interest owed on this debt was, like rent, a form of “secondary exploitation.” “That the working class is also swindled in this form, and to an enormous extent, is self-evident,” Marx wrote. “This is secondary exploitation, which runs parallel to the primary exploitation taking place in the production process itself.”[3]Karl Marx, Capital: Volume Three (London: Penguin Books), p. 230, 745.

The specific forms of working-class indebtedness have changed, as Eli Jelly-Schapiro’s “Working Lives in Debt” shows. From the explosion of pawnshops in the proletarian quarters of nineteenth-century cities where working-class women weekly pawned and redeemed coats and pocket watches, to the credit cards and payday loans of the twenty-first century, the fees and interest rates of pawnbrokers, credit drapers, loan sharks, and sub-prime lenders have always been deducted from those living from wage packet to paycheck. Moreover, in periods of declining real wages, like the last forty years in the United States, households fall further and further behind in their attempt to pay for the costs of daily life: household debt doubled, as a percentage of disposable income, between 1975 and 2005 (from 62% to 127%). The “household debt bubble,” as John Bellamy Foster called it in his prescient Monthly Review essay two years before the financial crisis, developed because, “in a period of stagnant wages, working people are increasingly…borrowing in order to make ends meet.”[4]John Bellamy Foster, “The Household Debt Bubble,” Monthly Review (May 2006), p. 2.

As a result, struggles over debt, like struggles over rent, are as important to working-class politics as struggles over wages.

If this begins to answer the first question — why are we in debt? — the second question might seem perverse. Why do we believe that we are in debt? Because we are, you might say, although ethnographers of working-class debt have found that people often don’t think of themselves as being in debt unless they are behind in their payments.[5]Sean O’Connell, Credit and Community: Working-Class Debt in the UK Since 1880 (Oxford: Oxford University Press, 2009), p. 20.

But this would miss the peculiar fetishism of debt. I borrow the phrase from Marx’s classic analysis of the fetishism of commodities in the opening chapter of Capital where he unveils the “mystical character” of commodities whereby social relations assume the fantastic form of relations between things. Too often we forget that the fetishism of commodities is only one form of capitalist fetishism, and that fetishism itself was only one mechanism of a larger process that Marx called, in English, “the religion of everyday life.”[6]Marx, Capital: Volume One, p. 164-165; Marx, Capital: Volume Three, p. My account of the fetishism of household consumer debt is indebted to Michael Taussig’s invention of the phrase … Continue reading

The “religion of everyday life” referred not only to our habitual, common sense, everyday consciousness of the world but also the structural inversion by which the capitalist mode of production produced this consciousness. Marx identified two key mechanisms of this “religion of everyday life”: on the one hand, fetishism or the “personification of things”; and on the other hand, reification, or the “thingification of social relations.” Together, the personification of things and the thingification of social relations create the peculiar inversions and disguises of what he called the “bewitched, distorted, and upside-down world haunted by Monsieur le Capital,” adding that “the actual agents of production…feel completely at home in these estranged and irrational forms.”[7]Marx, Capital: Volume Three, p. 969.

The fetish character of commodities was, Marx said, “relatively easy to penetrate” compared to the other fetishized and reified forms in this religion of everyday life. He wrote powerfully of the fetishism of the “wage,” which erases the line between necessary and surplus labor, and of the fetishism of interest-bearing “capital,” where “money breeds money,” just as pear trees produce pears.[8]Marx, Capital: Volume One, p. 176. Marx, Capital: Volume Three, p. 516. The fetishism of wages is discussed in chapter 16 of volume 1; the fetish of capital in chapter 24 of volume 3.

Marx didn’t analyze the fetishism of debt: though he recognized consumer debt, noting that wage earners could only become “debt slaves” in the realm of consumption, he didn’t include it with the commodity and the wage as a fetish form. Since workers in the capitalism of his day had little formal access to credit, their consumption debts appeared to be a secondary exploitation on the margins of the capitalist economy, like the pawnbrokers Marx was all too familiar with. However, over the last century, the steady creation of new forms of working-class household debt, from installment buying to the credit card, not only made worker’s debts a fundamental part of the realization of capital, but has also made the fetishism of debt a key instance of the religion of everyday life.

I would suggest that the fetishism of debt is based on a similar process as the other forms of fetishism: it is a bizarre time reversal that creates the illusion, and reality, of working-class indebtedness. In the fetishism of debt, what appears to be a lending of money by capital to wage earners is actually a borrowing in kind by capital. This sounds odd, but there is one moment when the fetishism of debt reveals itself: every time one takes a new job, one is reminded that you must support yourself without pay for the first day, week, or month. For one of the most curious aspects of the fictitious commodity the temp agencies call “manpower” is that it is one of the few commodities that is consumed before it is paid for. With most commodities, one pays and then enjoys. There are a handful of quotidian exceptions, like the restaurant meal — hence the deeply frowned-upon act of skipping out on a check.[9]In fast food, one pays first; McDonalds and Starbucks might better be called fast pay.

We do often get to use a commodity before paying for it, but these are always seen as a loan by the retailer or by a third party like a credit card issuer.

Only in the case of wage labor is the commodity used up before it is paid for; “everywhere,” Marx noted in an aside in Capital, “the worker allows credit to the capitalist.” Perhaps the most revealing metaphor we have of this time warp is that, in the rare instances where someone is paid before working, it is called an “advance,” a usage that goes back in English to the early eighteenth century.[10]Marx, Capital: Volume One, p. 278-9: For sake of his argument, Marx then returned to the assumption that the worker is paid immediately. The Oxford English Dictionary notes Alexander Pope’s use … Continue reading

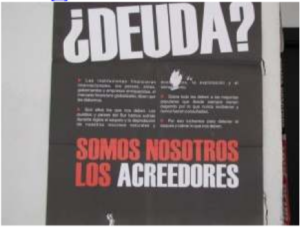

So, as a protest poster in Madrid put it in May of 2010 – “Debt? We are the creditors.”[11]See: “Debt? We are the creditors.” Conference in Madrid May 2010.

Everyday we make an interest-free loan of our labor power to our employers. And, short of cash, we are forced to take out interest-bearing loans to cover the “revolving” costs of eating and dressing and living, as well as the long-term costs of housing, commuting, procreating and schooling. Life, in this upside-down world, is always in hock to labor; we always seem to be in debt, and, through the religion of everyday life, we believe that we are debtors.

Marx argued that the fetish of the wage was the basis of “all the notions of justice held by both the worker and the capitalist…all capitalism’s illusions about freedom.” In a parallel way, I would like to conclude by suggesting that the fetishism of debt is the basis for all of our notions – held by workers and capitalists alike — of the morally deficient consumption practices of working-class people: we are told, and we believe, that we have a congenital disposition to live beyond our means. Not only do we forget that we are creditors; we believe that we are in debt, and that we deserve to be in debt. We are unable to save, to plan, to control our desires and our appetites: we are all shopaholics, subprime borrowers. Such is the power of the fetishism of debt.

References

| ↑1 | Mark Landler, “Outside U.S., Credit Cards Tighten Grip,” New York Times (August 9, 2008) |

|---|---|

| ↑2 | David Harvey, The Limits to Capital (Chicago: University of Chicago Press, 1982), pp. 253, 239 (my emphasis). |

| ↑3 | Karl Marx, Capital: Volume Three (London: Penguin Books), p. 230, 745. |

| ↑4 | John Bellamy Foster, “The Household Debt Bubble,” Monthly Review (May 2006), p. 2. |

| ↑5 | Sean O’Connell, Credit and Community: Working-Class Debt in the UK Since 1880 (Oxford: Oxford University Press, 2009), p. 20. |

| ↑6 | Marx, Capital: Volume One, p. 164-165; Marx, Capital: Volume Three, p. My account of the fetishism of household consumer debt is indebted to Michael Taussig’s invention of the phrase “fetishism of debt” to capture the equally but different topsy-turvy world of debt peonage. Michael Taussig, Shamanism, Colonialism, and the Wild Man (Chicago; University of Chicago Press, 1987), p. 60-73, 128-130. |

| ↑7 | Marx, Capital: Volume Three, p. 969. |

| ↑8 | Marx, Capital: Volume One, p. 176. Marx, Capital: Volume Three, p. 516. The fetishism of wages is discussed in chapter 16 of volume 1; the fetish of capital in chapter 24 of volume 3. |

| ↑9 | In fast food, one pays first; McDonalds and Starbucks might better be called fast pay. |

| ↑10 | Marx, Capital: Volume One, p. 278-9: For sake of his argument, Marx then returned to the assumption that the worker is paid immediately. The Oxford English Dictionary notes Alexander Pope’s use of the expression “a week’s wages Advance” in 1716. |

| ↑11 | See: “Debt? We are the creditors.” Conference in Madrid May 2010. |